In today’s digital age, credit cards have become an essential tool for financial transactions. Whether you’re shopping online, paying for groceries, or booking a vacation, your credit card is often the method of choice. While credit cards offer convenience and security, they also come with risks. Understanding these risks and how to mitigate them is crucial to keeping your financial information safe. This article will explore the key risks to credit card security and provide valuable insights into how you can protect yourself.

Key Takeaways

Credit card security is crucial in today’s digital landscape, where threats like phishing, data breaches, and fraud are ever-present. While the risks are real, taking preventive measures can greatly reduce the likelihood of falling victim to fraud. Always stay vigilant, monitor your accounts regularly, and implement strong security practices. The more you protect your credit card information, the safer your financial transactions will be.

Phishing and Social Engineering Attacks

What is Phishing?

Phishing is one of the most common types of cybercrime today. It involves tricking individuals into revealing sensitive information, such as credit card details, by pretending to be a trustworthy entity. Cybercriminals often use emails, phone calls, or fake websites to deceive people into providing their credit card numbers or login credentials.

How Does Phishing Work?

Phishing scams typically involve a fraudulent email that appears to come from a reputable source, such as your bank, an online retailer, or even a government agency. These emails often contain urgent messages, such as a security alert about your account, and include a link to a fake website designed to look like the real one. When you click on the link and enter your credit card details, the cybercriminals steal your information.

How to Avoid Phishing Scams

To avoid falling victim to phishing scams, never click on links in unsolicited emails. Always verify the sender’s email address and be cautious of messages that sound too urgent or unusual. If you’re ever in doubt, contact the organization directly using a verified phone number or email address.

Data Breaches and Hacks

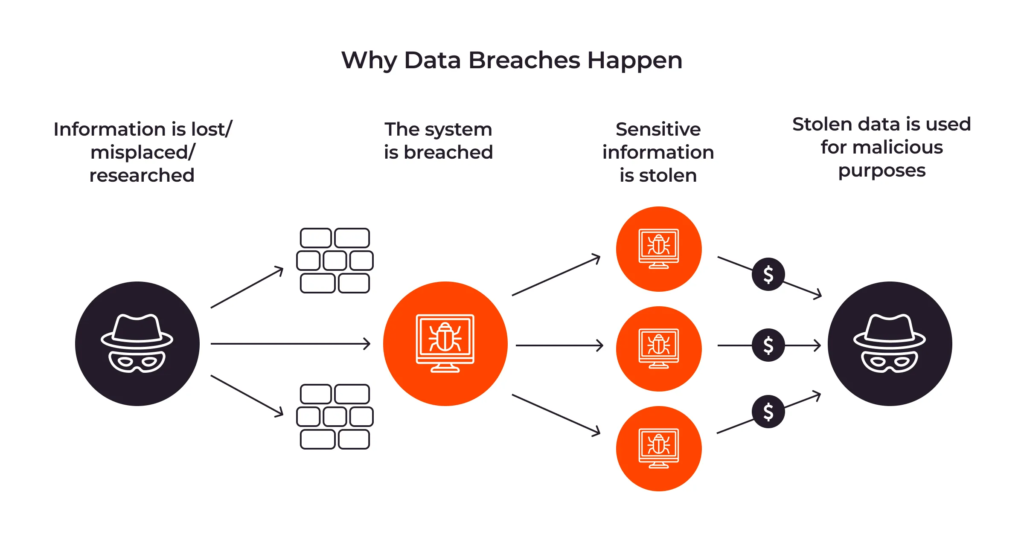

What Are Data Breaches?

Data breaches occur when sensitive data, such as credit card information, is accessed or stolen by unauthorized individuals. Hackers typically target businesses that store large volumes of customer data, such as online retailers, financial institutions, or healthcare providers. Once they breach the system, they can steal or sell your credit card information.

How Are Data Breaches Linked to Credit Card Security?

When a company experiences a data breach, your credit card details may be exposed. Cybercriminals can use this information to make fraudulent purchases, or they can sell the data on the dark web. Major breaches, like those at Target or Equifax, have affected millions of customers’ credit card information.

Protecting Yourself from Data Breaches

While you cannot prevent data breaches from happening, you can take steps to minimize their impact. Regularly check your credit card statements for unauthorized transactions, and use credit monitoring services to detect any unusual activity. Additionally, using credit cards with fraud protection services, such as EMV chip technology, can provide an added layer of security.

Credit Card Skimming

What is Credit Card Skimming?

Credit card skimming is a form of fraud in which criminals install small, discreet devices (skimmers) on ATMs, gas station pumps, or other point-of-sale terminals. These devices are designed to collect information from the magnetic stripe of your card, such as your card number, expiration date, and even your PIN.

How Does Skimming Work?

When you insert your credit card into a compromised terminal, the skimmer captures your credit card information without your knowledge. The thief then uses this information to create duplicate cards or carry out unauthorized transactions.

How to Avoid Credit Card Skimming

To protect yourself from skimming, inspect ATMs and point-of-sale machines for any signs of tampering, such as unusual attachments or loose parts. If a machine looks suspicious, report it immediately. It’s also a good idea to cover your hand when entering your PIN and always use machines in well-lit, secure areas.

Lost or Stolen Credit Cards

What Are the Risks of Lost or Stolen Credit Cards?

If your credit card is lost or stolen, criminals can easily gain access to your account and make unauthorized purchases. Even if you report your card lost or stolen right away, the thief may have already made fraudulent transactions.

What Should You Do If Your Card Is Lost or Stolen?

If you lose your credit card or suspect it has been stolen, contact your credit card issuer immediately. Most credit card companies have a 24/7 hotline for reporting lost or stolen cards. They will deactivate your card and issue a new one. It’s also essential to monitor your account for any unauthorized transactions.

Weak Passwords and Unsecured Websites

| Risk | Description | How to Mitigate | Best Practices |

|---|---|---|---|

| Weak Passwords | Weak or easily guessable passwords increase the likelihood of unauthorized access to accounts. | Use strong, unique passwords for each account. | – Use a mix of upper and lowercase letters, numbers, and symbols. |

| Password Reuse | Reusing the same password across multiple sites makes it easier for hackers to gain access. | Avoid reusing passwords across multiple accounts. | – Use a password manager to keep track of unique passwords. |

| Lack of Two-Factor Authentication (2FA) | Without 2FA, an account is more vulnerable to being compromised if the password is stolen. | Enable 2FA for all online accounts that support it. | – Use app-based or SMS-based authentication for extra security. |

| Unsecured Websites | Websites without HTTPS or proper encryption may expose sensitive information during transactions. | Ensure websites are secure by looking for “HTTPS” and a padlock symbol in the browser. | – Always shop or enter sensitive information on websites with HTTPS. |

| Data Breach Vulnerability | Weak passwords and unsecured websites can lead to breaches, exposing personal and financial data. | Monitor accounts regularly for unauthorized activity. | – Use credit monitoring services to detect any potential breaches. |

| Phishing and Malware Risks | Weak security practices, like using weak passwords or visiting unsecured sites, can make you more vulnerable to phishing attacks and malware. | Be cautious of phishing emails and use antivirus software. | – Verify the legitimacy of emails and avoid clicking on suspicious links. |

How Do Weak Passwords Affect Credit Card Security?

Weak passwords are a significant risk to your credit card security, especially when shopping online. Cybercriminals can easily guess common passwords, gain access to your accounts, and make fraudulent purchases. Passwords that are simple or reused across multiple sites are especially vulnerable.

The Importance of Secure Websites

When shopping online, always check for HTTPS in the URL, indicating that the website uses encryption to protect your data. Avoid entering your credit card details on websites that don’t display the HTTPS protocol or have a padlock symbol in the browser address bar.

Best Practices for Strong Passwords and Secure Sites

Use strong, unique passwords for each of your online accounts, and consider using a password manager to keep track of them. Enable two-factor authentication (2FA) wherever possible to add an extra layer of security. Always shop on reputable websites, and look for signs of security, such as secure payment gateways.

Fraudulent Transactions

What Are Fraudulent Transactions?

Fraudulent transactions are purchases made using stolen or unauthorized credit card information. These transactions can be hard to detect because they may not appear immediately on your account, and some may involve small amounts to avoid detection.

How to Detect Fraudulent Transactions?

Regularly check your credit card statements and look for any unauthorized or unfamiliar charges. If you spot anything suspicious, report it to your credit card issuer right away. Many companies offer transaction alerts that notify you of any charges made to your account in real time.

Identity Theft

How Does Identity Theft Relate to Credit Card Security?

Identity theft occurs when criminals use your personal information, such as your name, address, and credit card details, to impersonate you. Once they have your information, they can open new credit accounts in your name, make purchases, or apply for loans.

How to Protect Yourself from Identity Theft?

Preventing identity theft requires a multi-layered approach. Regularly monitor your credit reports for suspicious activity, use strong passwords, and avoid sharing sensitive information over unsecured channels. Consider freezing your credit with the major credit bureaus to prevent unauthorized access to your financial records.

How to Protect Yourself from These Risks

Implement Strong Security Measures

- Enable Two-Factor Authentication (2FA): Always enable two-factor authentication for your online accounts to add an extra layer of protection.

- Use a Credit Monitoring Service: Monitor your credit regularly to detect any signs of fraud or identity theft.

- Activate Fraud Alerts: Set up alerts with your credit card issuer to get notified of any unusual activity on your account.

Practice Good Habits

- Regularly Change Passwords: Change your passwords periodically, and avoid using the same password for multiple accounts.

- Avoid Public Wi-Fi for Transactions: Public Wi-Fi networks are not secure. Always use a VPN or a secure connection when making financial transactions.

- Be Cautious with Your Information: Never share your credit card details over the phone or through email, especially with unsolicited requests.

Also Read :- How Can You Lower Your Credit Card Interest Rates?

Conclusion

Credit card security is an essential aspect of safeguarding your financial well-being in today’s interconnected world. With risks such as phishing, data breaches, credit card skimming, and identity theft looming around every corner, it is crucial to remain vigilant and proactive in protecting your information. By understanding the potential threats and taking the necessary steps to mitigate them, you can reduce your risk of falling victim to fraud.

Implementing strong security measures, such as enabling two-factor authentication, using secure websites, regularly monitoring your credit card statements, and exercising caution in everyday transactions, will go a long way in securing your credit card details. While you can never completely eliminate all risks, being informed and prepared will help you navigate the complexities of credit card security with confidence.

In the end, taking simple yet effective precautions can help you enjoy the convenience of credit cards without compromising your personal and financial security. Always remember: prevention is key, and staying informed is your best defense against potential threats.

FAQs

What should I do if I notice a fraudulent transaction on my credit card?

Immediately contact your credit card issuer to report the fraudulent charge. They will typically freeze your account, investigate the transaction, and issue a new card if necessary.

How can I tell if a website is secure for entering my credit card information?

Look for “HTTPS” in the URL and a padlock symbol next to the URL in your browser. These indicate the website is using encryption to protect your data.

How often should I check my credit card statement for fraud?

You should check your credit card statements regularly, at least once a month. Setting up transaction alerts can help you catch fraud in real-time.

Can I prevent credit card fraud entirely?

While it’s impossible to prevent credit card fraud entirely, you can reduce the risk by using strong passwords, monitoring your accounts, and practicing caution when shopping online.

Is it safe to store my credit card information on websites?

Only store your credit card information on reputable websites with strong security measures (HTTPS). Consider using a secure payment system like PayPal or a virtual credit card number for extra protection.

What is credit card skimming?

Credit card skimming is a type of fraud where a device is secretly attached to a legitimate card reader, like an ATM or gas pump, to steal your card details when you swipe or insert it.

How can I protect my credit card if it’s lost or stolen?

Report your lost or stolen card to your credit card issuer immediately. They will deactivate your card and issue a replacement. Always monitor your account for unauthorized transactions.